Are you ready to expand your eCommerce business into new states, but eCommerce sales tax complexity is actively blocking your growth? Sales are growing, you’ve optimized your supply chain, and demand is strong. Then you get lost in a confusion of sales tax rules:

- South Dakota says you need to collect at $100K in eCommerce sales.

- California’s threshold is $500K.

- Colorado wants you to track transaction counts.

The multitude of varied state rules can easily deter businesses from entering new markets due to tax uncertainties and fear of breaking the rules.

This guide covers essential information on eCommerce sales tax, including best practices, common mistakes, and a breakdown of the nexus laws that affect each state — so that you can grow your business across state lines without fear.

What is eCommerce Sales Tax & Why Does It Matter?

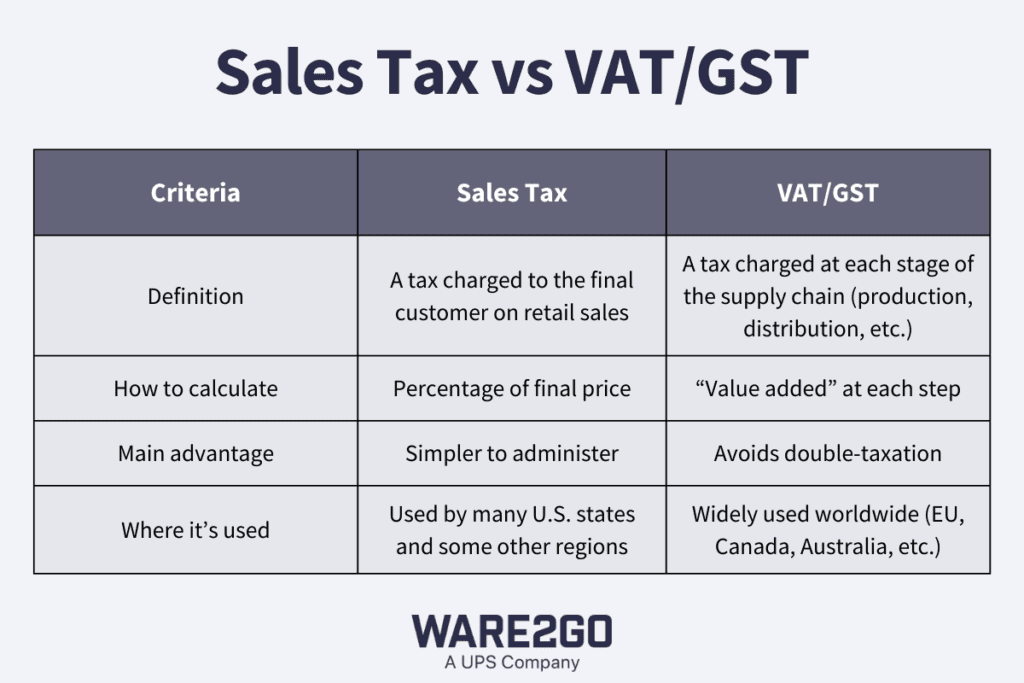

At a high level, eCommerce sales tax is a straightforward concept: Whenever a business sells taxable goods or services online, it must collect sales tax from the buyer and remit those funds to the appropriate tax authority.

While this definition sounds simple, the complexity lies in selling across different jurisdictions, each with its own rates, rules, and requirements.

In the United States, for instance, sales tax regulations can vary not only from state to state but also across local jurisdictions. Internationally, the situation becomes even more complicated, as VAT (Value-Added Tax) and GST (Goods and Services Tax) systems differ between countries.

Sales tax rules can also vary depending on the type of sale. For example, “buy online, pick up in store” (BOPIS) transactions typically apply the store’s local tax rate, which may differ from the buyer’s home address. Plus, “buy now, pay later” (BNPL) plans require the seller to collect and remit sales tax on the full purchase amount at the time of sale—regardless of the installment schedule.

The rules for eCommerce sales tax have also changed over the years, with one of the largest shifts being driven by the Wayfair decision.

The Wayfair Decision: Why eCommerce Sites Have to Charge Sales Tax

On June 21, 2018, the U.S. Supreme Court’s ruling in South Dakota v. Wayfair overturned the 1992 Quill Corp. v. North Dakota decision. This landmark judgment granted states the right to require out-of-state sellers to collect and remit sales tax, even if they lack a physical presence within state borders.

In 1992, when Quill was decided, remote retail mostly meant catalog and telephone orders — a fraction of total sales with minimal impact on state tax revenues. Fast-forward to 2018, and the eCommerce sector had exploded, surpassing $500 billion in annual online sales.

States were losing significant tax revenue in this new digital marketplace, prompting the Supreme Court to acknowledge the need for an updated decision. By allowing states to adapt their sales tax laws to modern realities, the Wayfair decision aligned sales tax enforcement with the rapid growth of online commerce. In 2021, states collected $30 billion in remote sales taxes.

As a result, businesses must now keep track of transactions across multiple states and charge sales tax wherever they’ve established a “sales tax nexus.” That usually means selling above a minimum threshold in one year or meeting other individual requirements depending on the state. We’ll discuss this in more detail shortly.

This expansion of sales tax responsibilities can be particularly challenging for hyper-growth online retailers with a national presence. Beyond daily operations, they must manage compliance across numerous jurisdictions, each with its own filing deadlines, rates, and rules.

Staying ahead means understanding where your business meets nexus thresholds and ensuring you collect and remit the correct amount of sales tax in each applicable location. Whether through automation tools or professional consultation, proactive management of sales tax obligations helps eCommerce brands mitigate risks and safeguard their bottom line.

Ignoring these obligations would come at a steep cost, potentially leading to hefty unpaid liabilities, penalties, and interest charges. High-growth companies also tend to attract media and regulatory attention, increasing the chances of an audit.

To understand those implications, let’s take a closer look at why maintaining compliance is so critical.

The Benefits of Tracking eCommerce Sales Taxes

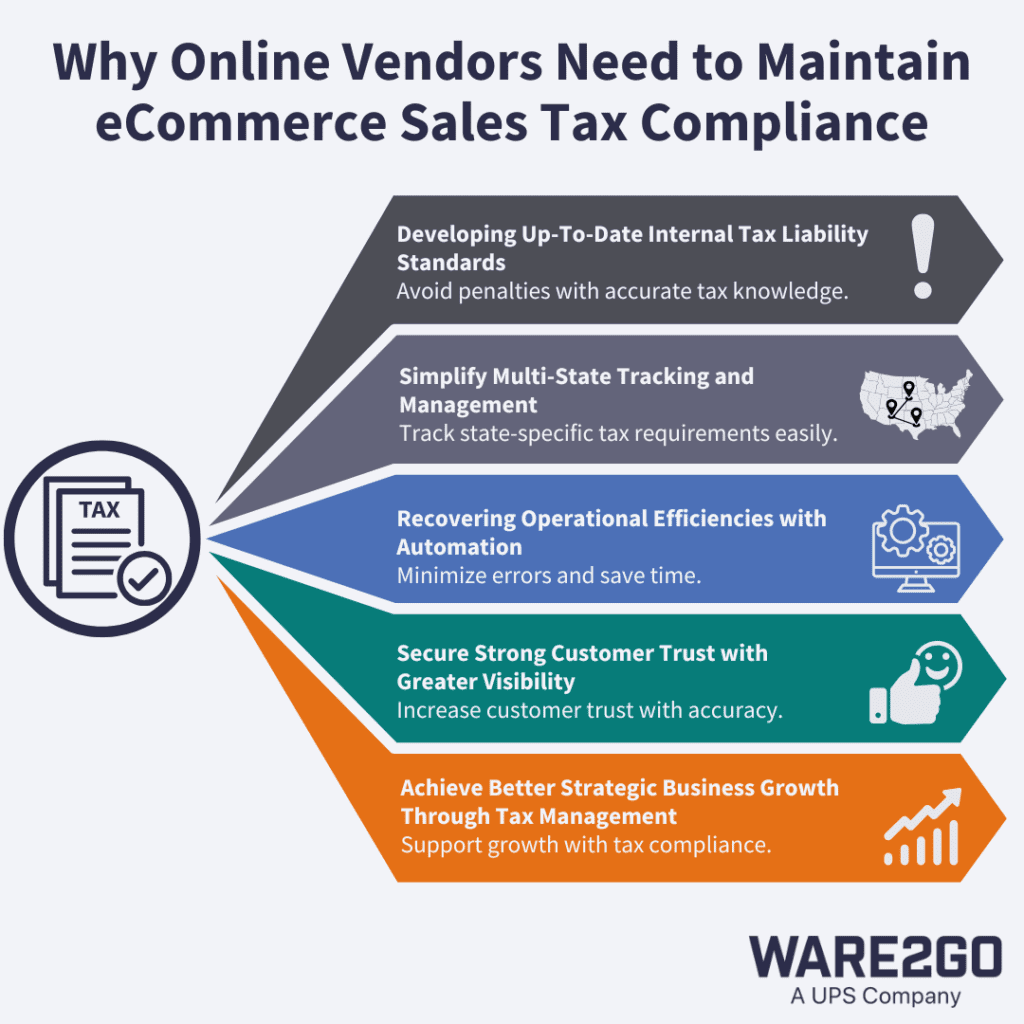

Obviously, the biggest benefit of keeping track of your eCommerce sales taxes is that you stay compliant with the law. But there are several benefits on top of that. Here are all the ways that compliance can help your business grow.

Developing Up-To-Date Internal Tax Liability Standards

Establishing clear internal tax liability standards protects businesses from penalties that can reach 10–30% of unpaid taxes. By continually monitoring each state’s rules, companies minimize audit risks, safeguard profitability, and position themselves to scale.

Simplify Multi-State Tracking and Management

Interstate commerce creates a patchwork of tax obligations, each with distinct thresholds and rates. Monitoring sales across multiple jurisdictions demands meticulous record-keeping to avoid unexpected liabilities. Understanding state-specific requirements is crucial for ongoing compliance.

To do this, schedule regular reviews of tax regulations and update your internal processes accordingly. Ensure your team gets ongoing training and clear guidelines on new or changing tax requirements.

Recovering Operational Efficiencies with Automation At the Right Points

Tax automation software can accurately calculate and remit sales tax across all channels. By integrating with sales platforms, these solutions reduce manual workloads and errors, freeing teams for strategic growth. Automated compliance also boosts scalability by standardizing processes.

That’s why you should use specialized tax tracking tools or modules that automatically update state-specific rates and thresholds. Maintain consistent data collection, and designate a compliance manager or team to stay on top of any changes to local rules.

Secure Strong Customer Trust with Greater Visibility

Accurate tax calculations build customer confidence when shoppers verify charges before checkout. Confusing taxes can spike cart abandonment and erode brand reputation, whereas transparent practices strengthen loyalty in the long term.

To maintain that trust, display clear, itemized tax details on checkout pages, invoices, and receipts. Be sure your customer support team has appropriate resources to answer any questions about how you calculate sales tax.

Achieve Better Strategic Business Growth Through Tax Management

Comprehensive tax oversight supports sustainable expansion into new markets. By anticipating how different states handle sales tax, businesses can plan for operational changes. This foresight promotes scalable growth and sharpens competitive advantage.

Before you expand into a new market, research and map out your potential tax obligations. Consider consulting tax professionals or using specialized tax management tools to identify and address multi-state compliance challenges proactively.

Location Matters: Understanding Location-Specific Rules Affecting eCommerce Sales Tax

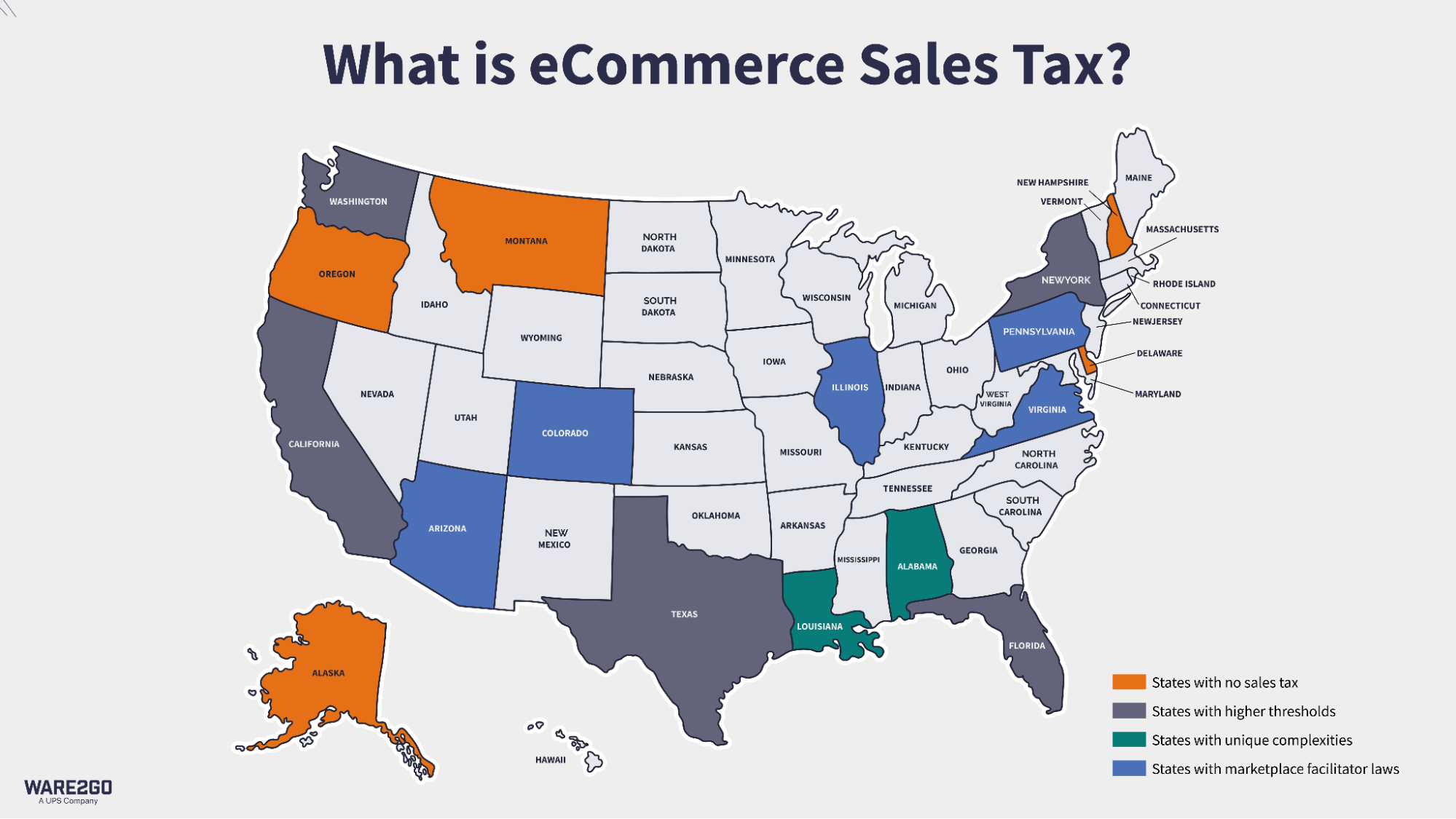

Location is key in eCommerce sales tax. Sales tax nexus thresholds (like $100,000 or 200 transactions in South Dakota) are just the start. Sourcing rules and shipping tax requirements also shape remote sellers’ obligations — always remember to verify each state’s specific criteria.

Let’s look at how different states approach these calculations:

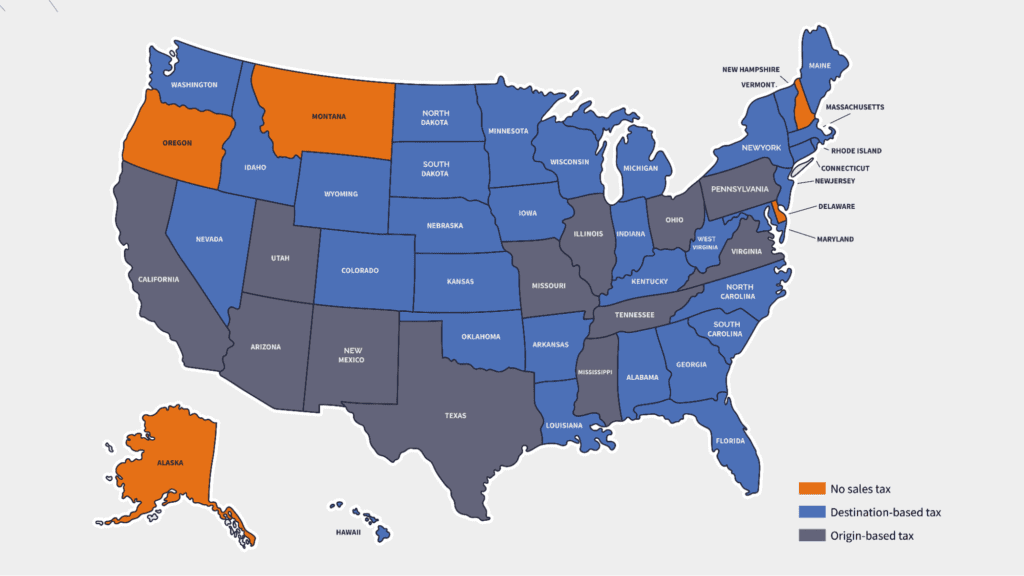

Origin-Based States

Using this model, sales tax is calculated based on the remote seller’s location. States like Texas, Pennsylvania, and Ohio follow this method. Think of it as “home base” tax rules. If you’re selling from Texas (an origin-based state), you’ll charge Texas rates, even when shipping to California.

Destination-Based States

In this case, sales tax is calculated based on the buyer’s location. The majority of states use this approach. You generally use destination-based rates for sales to customers in other states where you have a sales tax nexus. It’s important to configure your eCommerce platforms accordingly to ensure correct tax rates are applied.

You can see a full map of each state’s sales tax type below. But be careful — some have even more local nuances. For example, district-based taxes in California are destination-based, but other sales taxes (such as the state sales tax) are origin-based.

Let’s walk through how to know when you have a sales tax nexus. Then, we’ll dive deeper into how to ensure you’re compliant with state and district tax rules when there is a nexus.

The Role of the Sales Tax Nexus for eCommerce Sales Tax

The first step to determining whether your online sales are subject to state sales tax is understanding which states your business has a “nexus.”

Each state has different criteria for determining what is considered a nexus. The criteria range from exceeding a dollar amount threshold in sales to making sales at trade shows within the state.

For example, your business will have an economic nexus in South Dakota if you generate more than $100,000 in taxable remote sales, or over 200 separate transactions delivered anywhere in the state.

These criteria are relatively simple, but some factors that can trigger a nexus in other states include having a warehouse in that state, having a third party dropshipping partner within the state, and sometimes even having a partnership with an affiliate marketer in the state. It’s important to be familiar with each state’s nexus criteria to know in which states you will be required to pay sales tax.

It’s also important to note that not all products are taxable in every state. Clothing, for example, is not subject to state sales tax in Pennsylvania, and grocery items get a 1% sales break in the state of Illinois. Knowing whether your product is even taxable on a state-by-state basis can save you time, money, and a mound of paperwork.

5 Important Nexus Types for eCommerce Vendors

Each of the 44 states and the federal district that imposes sales tax has its own laws defining nexus thresholds.

Furthermore, some states, known as Home Rule states (like Colorado and Louisiana), allow local jurisdictions to set and administer their own sales tax rates and regulations independently.

This complexity results in over 12,000 tax jurisdictions nationwide, each with unique laws. Staying compliant requires businesses to be vigilant and up-to-date with these varying regulations.

These 5 nexus categories will help you figure out when and where your business might be required to collect and remit sales tax:

Economic Nexus

An economic nexus is an economic presence: a connection between your business and a jurisdiction established through economic activity, such as sales revenue or transaction volume, rather than physical presence.

In many states, surpassing $100,000 in sales or 200 transactions per year triggers a tax collection requirement. Today, 44 states have economic nexus laws, meaning you must monitor your cross-border sales closely. Staying aware of each state’s thresholds and updating your systems accordingly helps you meet these obligations and avoid costly penalties.

Physical Presence Nexus

If you own or lease property, hire employees, or store inventory in a given state, you automatically create a physical presence nexus in any state with a sales tax. Even short-term engagements like attending a trade show or sending traveling sales staff can trigger tax obligations.

Marketplace Facilitator Nexus

When you sell through third-party marketplaces such as Amazon or eBay, those platforms often handle tax collection on your behalf. However, you still need to track these sales for sales tax reports. Every state with a sales tax has a marketplace facilitator nexus law, although they can vary significantly between states.

Affiliate Nexus

Partnerships with in-state marketers can establish a nexus, even if your company never sets foot there. Commission-based deals or co-branded promotions can lead to tax obligations once a certain threshold is met, depending on the jurisdiction. This type of nexus is in 33 states, including California and Texas, although it was repealed in Colorado and Arkansas.

Click-Through Nexus

Referrals from in-state websites can also trigger nexus if they exceed set dollar or transaction thresholds. This is similar to the rules around affiliate nexuses, but you need to track it separately to be sure you’re in compliance. This type of nexus is less common, and it only exists in 15 states, such as New York, Pennsylvania, and Nevada. Notably, California, Texas, and Florida do not have click-through nexus laws.

8 eCommerce Sales Tax Best Practices for Online Sellers

As your online sales grow, managing sales tax obligations becomes more complex. The following best practices help you stay compliant, avoid penalties, and maintain seamless operations — no matter how many states you sell in.

#1: Monitor Your Sales Thresholds: The $100,000 or 200 Transactions Rule

Most states enforce economic nexus if you exceed $100,000 in sales or 200 transactions. However, there are higher-threshold states like California ($735,019 or a quarter of your total sales).

Key steps for monitoring:

- Understand thresholds and their tax implications: Keep track of sales in each state so you know exactly when you’re approaching the limit. This helps you avoid surprise obligations.

- Note areas with higher thresholds: Some states, like California and Texas, have raised the bar to $500,000 or more, so research each state individually.

#2: Automate Tax Calculation with Reliable Software

Manually calculating sales tax can cause mistakes, especially when rates vary by location. Automating this process streamlines compliance and reduces human error. It also eases the burden on staff, so they can focus on growth rather than tedious calculations.

Steps for implementation:

- Select reliable software (e.g., Avalara, TaxJar, or Vertexx) to handle various jurisdictions.

- Integrate with your eCommerce platforms so tax is calculated at checkout automatically.

- Test thoroughly by simulating sales in different states. Confirm that tax rates and remittance processes align with local laws and any recent changes.

#3: Maintain Audit-Ready Records

Audits can happen unexpectedly, so detailed record-keeping is vital to protect your business. Make sure to keep records like sales transactions, exemption certificates, tax filings, and payment confirmations.

How to organize your records:

- Use accounting software like QuickBooks or Xero for clear transaction tracking.

- Digitally store certificates with tools like CertCapture for easy retrieval.

#4 Register for Sales Tax Permits Before Reaching Thresholds

Registering early helps you avoid illegal tax collection or late filings. Begin the sales tax permit process when you approach 80% of the threshold to ensure you’re fully compliant once you cross it.

Steps for proactive registration:

- Research state requirements on the Department of Revenue website.

- Assemble required documents (EIN, business license) ahead of time.

- Apply as you approach the threshold so you’re ready to collect tax legally.

#5 Verify Customer Information for Accurate Tax Application

Incorrect addresses or missing exemption certificates can lead to charging the wrong tax rate and potential penalties. That’s why it’s important to verify addresses and validate exemption certificates so you’re not held liable for uncollected taxes.

How to start verification:

- Integrate your shopping cart with tools like SmartyStreets.

- Update customer data regularly to avoid outdated information.

- Store exemption certificates securely using solutions like CertCapture.

#6 Understand Your Product’s Tax Status in Each State

Taxability varies by location — clothing might be exempt in one state but taxable in another.

Understanding tax status involves:

- Researching each state’s rules using resources like Avalara’s Taxability Matrix.

- Assigning accurate tax codes to ensure correct rates are applied at checkout.

- Staying updated on legislative changes through regular checks or subscriptions.

#7 Invest in Professional Tax Filing Solutions

Filing taxes across multiple jurisdictions is complex, so professional software can save time and reduce stress. Automated systems can prepare returns accurately and on schedule, preventing late fees or missed deadlines.

To use tax filing software:

- Choose a reliable solution (e.g., TaxJar AutoFile, Avalara Returns, Vertex Cloud) that suits your sales volume.

- Integrate with sales channels so data flows directly into your filing system.

- Set up filing calendars with reminders to ensure timely payments.

#8 Stay Informed on Tax Law Changes

State tax laws evolve, impacting your obligations from one year to the next, and missing updates on rate changes or revised thresholds can leave you exposed to audits and penalties.

To stay informed:

- Subscribe to updates from state tax agencies or local business associations.

- Use monitoring tools and set alerts to catch regulatory changes early.

- Review laws periodically and consult a tax advisor for extra certainty.

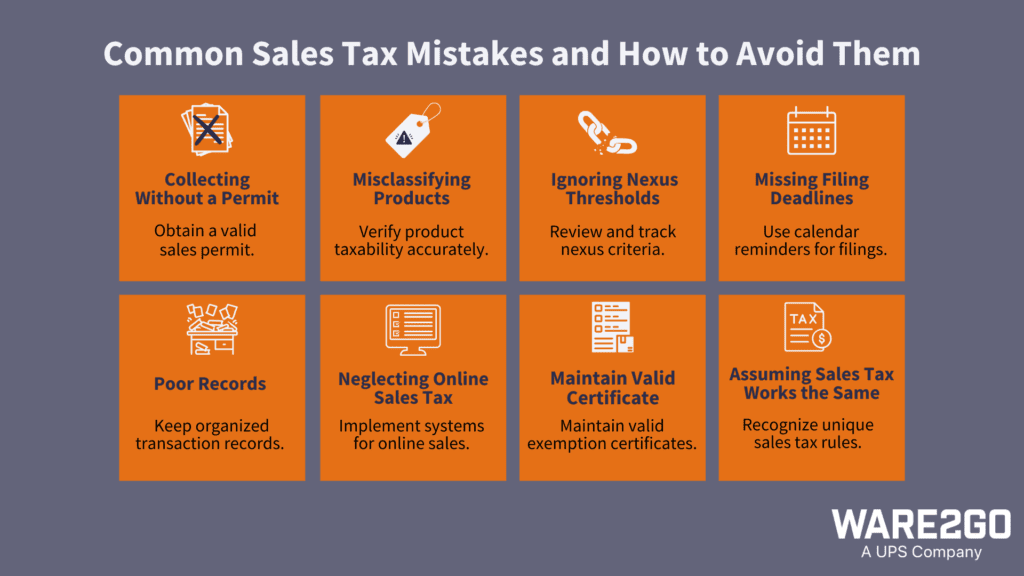

Common Sales Tax Mistakes and How to Avoid Them

Avoiding common mistakes protects your business from costly audits and penalties. Here’s a breakdown of pitfalls and how to sidestep them.

Collecting Without a Permit

Collecting sales tax without first obtaining a valid permit is illegal in many states and can trigger serious penalties or back taxes.

Solution: Ensure you have the proper sales tax permit in every state where you have a tax obligation before you begin collecting sales tax from customers. Confirm this with the local Department of Revenue or other tax authority.

Misclassifying Products

Applying the wrong tax rate because of improper product classification can lead to under- or over-collection of sales tax, leaving you open to non-compliance issues.

Solution: Research which items are taxable or exempt in each state where you sell, and correctly categorize your products based on the latest regulations.

Overlooking Nexus Thresholds

Overlooking state-specific economic or physical nexus thresholds can cause you to miss mandatory tax collection responsibilities. If you exceed a threshold without realizing it, you may face penalties for uncollected taxes.

Solution: Track your total sales and the number of transactions in every state. Use a system to alert you when you’re nearing or surpassing nexus thresholds.

Missing Filing Deadlines

Late filings typically result in penalties, interest charges, and a higher likelihood of an audit.

Solution: Keep an organized tax calendar with all filing dates, and set automated reminders to ensure you submit sales tax returns on time.

Poor Record-Keeping

Insufficient documentation makes audits and filings far more complicated, as you may lack the necessary proof of compliance.

Solution: Maintain comprehensive records of transactions, taxes collected, and any exemption certificates, ideally through reliable accounting software or cloud-based solutions.

Neglecting to Collect Sales Tax on Online Sales

Some businesses mistakenly believe online transactions do not require sales tax collection, leading to underpayment and potential audits.

Solution: Implement or configure sales tax collection for every online sales channel, ensuring you gather the correct amount based on the relevant tax laws.

Not Understanding Tax Exemptions and Exemption Certificates

Failing to correctly apply or document exemptions can result in either overcharging customers or under-collecting taxes.

Solution: Familiarize yourself with the exemptions in each relevant state, and store valid exemption certificates for qualifying customers.

Assuming Sales Tax Works Like Other Taxes

Sales tax laws differ significantly from income or corporate taxes, causing confusion and errors for businesses that treat them the same way.

Solution: Recognize that each state’s sales tax requirements are unique. Dedicate time or resources to learning these rules, or invest in professional guidance to keep your business compliant.

eCommerce Sales Tax FAQ

Here are a few of the most common questions about eCommerce sales taxes, and some quick answers.

Do I Need to Collect Sales Tax in Every State?

You only need to collect sales tax in states where you have a sales tax nexus (typically either a physical or economic nexus). Research each state’s rules you sell within to determine if you meet their specific thresholds.

What Is the Difference Between Economic Nexus and Physical Nexus?

Physical nexus arises from having a tangible presence in a state (e.g., a warehouse), while economic nexus is triggered by reaching certain sales or transaction thresholds, even without a physical location.

How Can I Track Varying Sales Tax Rates and Rules?

Use specialized tax software and regularly review state guidelines. Automated solutions help update rates in real time, ensuring you stay compliant across multiple jurisdictions.

Are Digital Products Subject to Sales Tax?

Rules differ widely. Some states tax digital goods (e.g., music downloads, streaming services), while others do not. Confirm each state’s stance before finalizing your pricing.

What Happens if I Don’t Comply With Sales Tax Laws?

Non-compliance can lead to penalties, interest charges, and audits. In extreme cases, authorities may impose liens or legal actions against your business, jeopardizing your operations.

Transform eCommerce Sales Tax into a Competitive Advantage

Sales tax compliance is essential for the success and scalability of eCommerce businesses. From monitoring thresholds to automating calculations and filing, a holistic strategy is required to ensure accurate tax collection and remittance across multiple jurisdictions.

A strategic, organized approach empowers sustainable growth, market expansion, and stronger customer relationships. Don’t get tripped by costly penalties — instead, prioritize sales tax best practices for your eCommerce operations.

To learn more about how Ware2Go is simplifying end-to-end solutions for online sellers like you, check out our solution.