Logistics data is key to building more efficient fulfillment operations that meet your customer’s eCommerce expectations without negatively impacting your bottom line.

Logistics data is key to building more efficient fulfillment operations that meet your customer’s eCommerce expectations without negatively impacting your bottom line.

Data analytics is becoming the go-to means to find efficiencies throughout the entire warehousing and fulfillment process. With 89% of small to midsized businesses (SMBs) recently reporting that they operate out of at least one owned warehouse, the ability to collect and analyze data at scale is becoming a core business need- especially given the booming growth of eCommerce. The power of logistics data is that it can inform every step of the supply chain while also spotting trends to help merchants forecast their demand and know when and how much inventory to order for replenishment.

Logistics data can also be used in business functions outside of the supply chain, such as marketing and demand generation. Merchants who have a clear understanding of where their customers are located can craft marketing campaigns that target their most profitable geographies. Those merchants can also build a distributed fulfillment network to enable 1- to 2-day ground shipping to their core customers.

The logistics industry is not historically known for its use of data, but according to a recent survey of small to midsized businesses (SMBs), that may be changing. The 2023 report on the future of fulfillment logistics, 36% of decision makers agreed that their time spent on warehousing and fulfillment could be alleviated by improved technology. A Warehouse Management System (WMS) that puts a premium on logistics data, analysis, and forecasting is becoming a must-have for SMBs to scale.

Logistics data is changing warehousing on the ground by increasing certainty around:

When these decisions are made with smart technology and logistics data, SMBs can realize bottom-line cost savings and drive top-line growth.

Ultimately, using logistics data to build a distributed fulfillment network unlocks the ability for SMBs to overcome one of today’s biggest eCommerce hurdles: fast and affordable shipping options for customers, while also lowering time in transit (TNT) to control last mile delivery costs. Likewise, by optimizing the entire fulfillment process through data, SMBs can mitigate an emerging concern: sustainability. According to a 2023 survey, 30% of SMB decision makers are concerned about sustainable eCommerce- both for the environment and for their business.

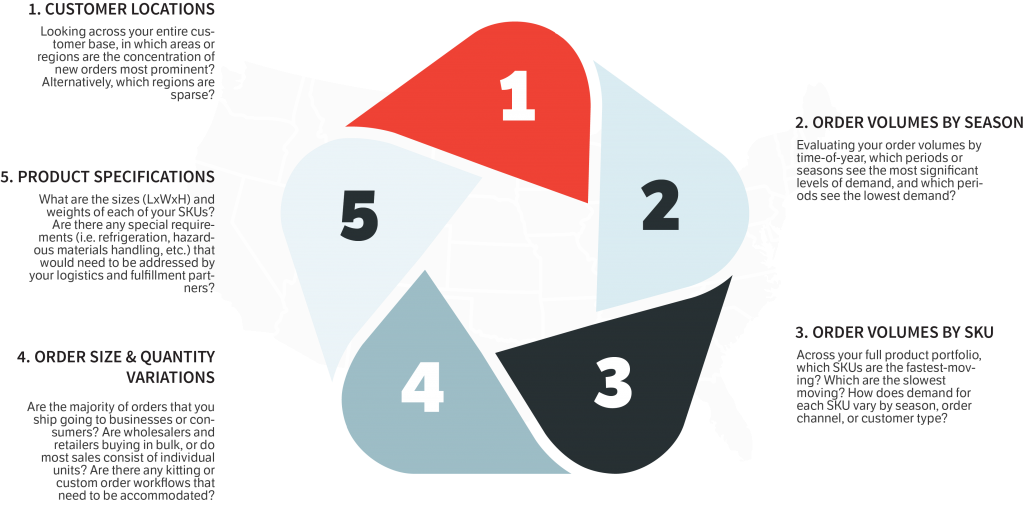

Let’s look at five areas where logistics data is being implemented to optimize fulfillment networks: customer geography, seasonal volume, order volume by SKU, order size and transit method, and product requirements.

As opposed to brick-and-mortar storefronts that require a customer’s physical presence, the rise of ecommerce has enabled buyers to effortlessly search for and purchase items online from virtually anywhere. For merchants, this means that many of the traditional barriers associated with gaining broad market exposure have been eliminated. However, ecommerce has also added new challenges for merchants, such as that of having to quickly deliver goods to customers that are spread across the globe. As ecommerce merchants increasingly recognize that their sales are coming from customers in numerous regions, many are transitioning towards fulfillment structures that offer a distributed warehouse network. This allows them to store portions of inventory in multiple locations. However, in order to leverage this type of network effectively, merchants must know where the bulk of their customers are located so that they know exactly where to place their inventory. In practice, this type of strategic analysis can enable merchants to rely on just three warehouses to reach their entire U.S. customer base in 1-2 days through standard ground shipping options. And with numerous 3PL and 4PL providers that offer distributed warehouse networks, knowing where their customers are located enables merchants to shop for the network that gives them the best coverage.

For merchants with distinct busy seasons, understanding how order volumes rise and wane throughout the year is essential for optimizing 3rd party fulfillment. In some industries, it is common for 30-40% of order volumes to occur within a 1-2-month period, such as the November-December holiday season. And because most warehouses will charge storage fees based on the amount of pallet space used throughout the year, the ability to reduce inventory capacity during the slow season and then ramp up in time for the busy season enables merchants to save significantly on inventory carry costs.

However, it is imperative that accurate data is gathered, as stock outages caused by unforeseen demand or unanticipated order spikes will do more harm than the costs of carrying extra inventory. Also, it’s important to ensure that a merchant’s selected warehousing provider will allow inventory to be scaled up or down throughout the year in this fashion. Reason being, some warehouses require year-long contracts with pre-specified inventory parameters that can prove restrictive for merchants that try to implement a seasonal approach to inventory management.

Just as important as understanding a business’s general seasonality is understanding the specific level of demand for each unique product. Although some businesses may choose to stock equal amounts of inventory across all their products, this can lead to unforeseen costs as slow-moving SKUs stay on the shelves longer and rack up additional storage fees. This approach can also complicate the restocking process, as varying demand levels for different SKUs will likely necessitate different restock amounts and cadences. Instead, analyzing demand for each unique product throughout the year enables merchants to determine how much of each SKU should be stored at any one time, how much is needed for restocking, and how often each should be restocked. This will ultimately allow them to reduce the carry costs associated with each product without running the risk of stockouts.

When it comes to selecting the transportation methods used to deliver orders, there are several elements to focus on. For instance, if merchants are selling to other businesses (particularly retailers and wholesalers), goods are typically bought in bulk. But for individual consumers, products are commonly bought as single units. Therefore, if merchants are selling to both businesses and consumers, they’ll likely need to leverage multiple transportation methods, including small parcel delivery services for customer orders all as well as LTL and FTL freight options for wholesale orders. Getting a handle on the range of order types and volumes that will occur is very important because different carriers (i.e. UPS, DHL, or FedEx) offer different rates depending on the size of the shipment and who the end recipient is (i.e. a business or consumer). For this reason, identifying the type of delivery options needed and the frequency with which each type is needed will help merchants select the best carrier(s) to service their business.

Across the full landscape of fulfillment providers and shipping carriers, the charges associated with handling products of various weights and sizes can vary broadly. For example, some warehouses might specialize in storing heavy or bulky items (i.e. products over 50 lbs.) and charge much less than their competitors, while others may only handle small retail goods and will charge hefty premiums for items over a certain weight or width. The same goes for shipping providers, who may charge premiums to ship items over 10 pounds or with dimensions exceeding 3-4 feet. Taking this a step further, products that require refrigeration or kitting or that are classified as hazardous materials are much more expensive to store and ship, and many providers may choose not to handle these types of items at all. So, if merchants are to truly optimize the costs associated with their fulfillment process, documenting these types of product specifications is a crucial step. This will ensure that across their full portfolio of SKUs, the warehousing and shipping partners selected can provide effective service.

Logistics data is the most powerful tool that SMB’s have at their disposal to improve shipping speeds without increasing fulfillment costs. Historically, access to logistics data has been an enterprise-level function. Most SMB’s don’t have the internal resources to interpret data into actionable insights to improve the efficiency of their fulfillment and shipping.

However, SMB’s can partner with a tech-enabled 3PL or 4PL with logistics and fulfillment software that integrates with all of their sales channels to aggregate WMS, TMS, and OMS data into real-world actions they can take to improve their business. For example, at Ware2Go, merchants can set alerts to notify them when inventory is low at the SKU level and the warehouse level. This allows them to get ahead of their replenishment orders to avoid costly stockouts and helps them get a high-level view of the geographic distribution of their customers. Ware2Go’s team of analysts also regularly reviews shipping data to identify warehouses that may be over-indexing on long-zone shipments and make recommendations for merchants to move their inventory to reduce time in transit and realize cost savings on their final mile shipments.

For small and mid-sized merchants that are serious about competing in today’s fast-paced ecommerce landscape, leveraging logistics data is essential for achieving 1 to 2-day delivery speeds without negatively impacting their bottom line. When looking for the best-fit fulfillment partner, asses not only their network scale and capabilities but how they plan to help you build your network strategically and whether they are analyzing the right data sets to transform fulfillment into a revenue driver for your business.

For a free network analysis and optimized network recommendations, reach out to one of our fulfillment experts for a consultation.