Supply chain disruptions like freight delays may continue well into the summer. Learn how to adapt and succeed in 2022 in spite of continued disruptions.

Freight Delays Effect on Merchants

Freight delays have affected consumers and merchants alike. The supply chain is just that – a chain – and when any one link in that chain is disrupted, the effects are felt all the way down the line.

Last holiday season, after navigating supply chain shortages and endless disruptions caused by the ecommerce boom, most merchants were prepared for an unusual and challenging Peak holiday season.

Among their top concerns were freight delays and freight prices:

- 36% were affected by elevated lead times

- 77% were affected by elevated freight costs

Freight Delays Effect on Consumers

Consumers, too, have felt the effects of freight delays. In fact, although 35% of consumers started their holiday shopping earlier in 2021, 59% still reported experiencing supply chain problems.

Stockouts, due to freight delays, were consumers’ number one issue. All told, 57% of shoppers reported making a purchase from a new retailer while holiday shopping. 37% of those shoppers did so because their first choice retailer was out of stock.

2022: Why Are Shipments Still Delayed?

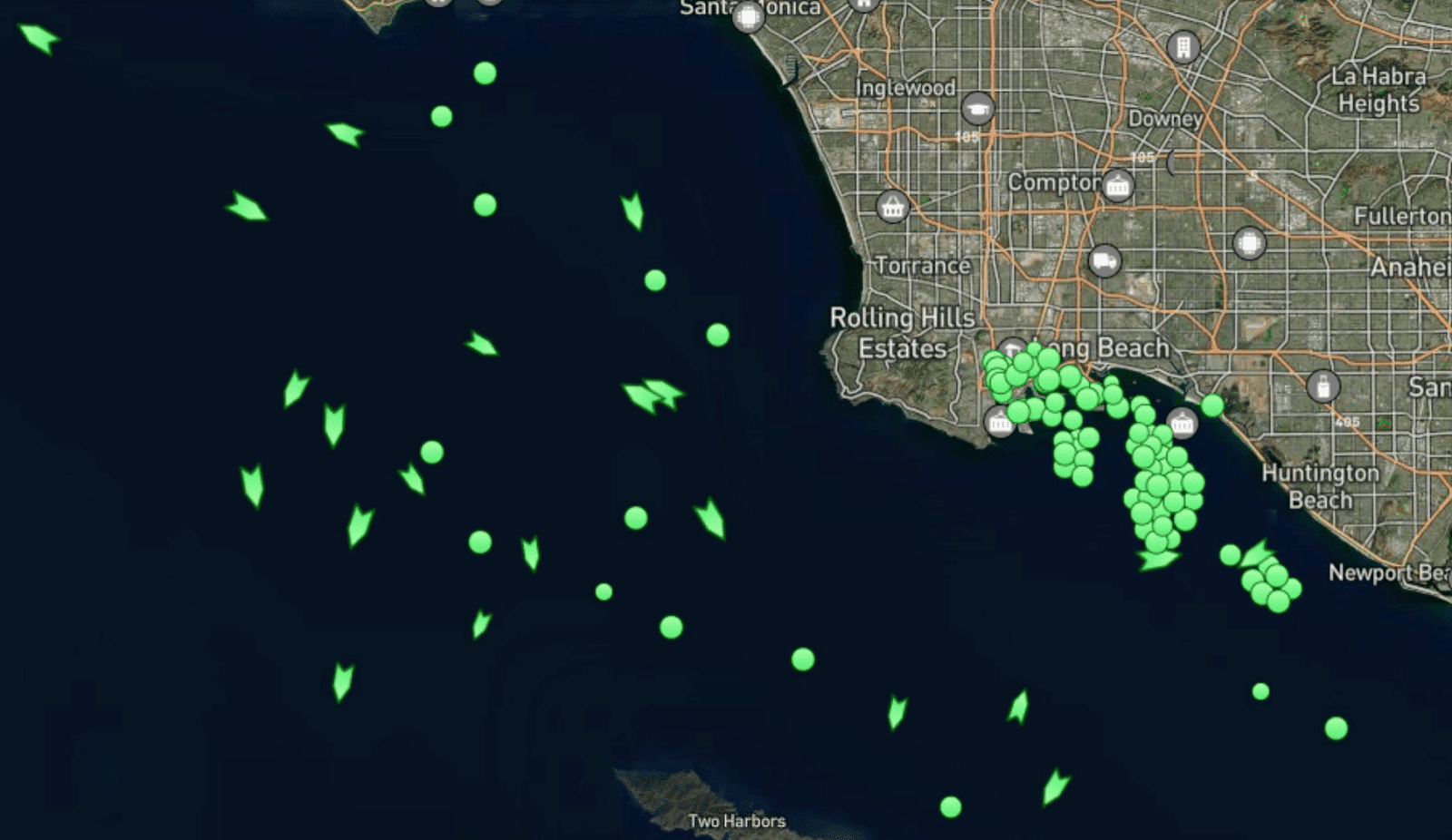

While the pandemic has challenged many links of the supply chain, freight delays are often the most misunderstood. The ships lined up outside of our busiest ports are visible from aerial views, giving a compelling concrete image that most viewers immediately understand.

While ocean freight delays have been most visible in the headlines, freight networks are incredibly complex. As most merchants know, inventory may travel by any combination of air, ocean, rail, or truck before it reaches a fulfillment center.

The freight delays affecting supply chain operations in 2022 are mutlifaceted. Merchants of all sizes may be struggling to keep their most popular SKUs in-stock, but merchants who build a resilient supply chain that prioritizes technology and strategic partnerships will have the flexibility to pivot and succeed in the face of disruptions.

Shutdowns Overseas

Manufacturing and China’s Zero COVID policy has led to manufacturing shutdowns and port congestion. Lockdowns are slowly easing, but experts estimate that effects of the current backlog will be felt well into the summer.

On the surface, China’s largest ports seem to be operating smoothly, with wait times for berths relatively low. However, lockdowns have prevented truck drivers from getting into or out of the ports, leaving products to pile up on both the import and export side. Once lockdowns have fully lifted and goods are moving again, volume will uptick significantly and likely overwhelm freight networks.

Port Congestion Stateside

Images of container ships floating outside of the ports, awaiting a berth, have become familiar to consumers and merchants alike. While secondary ports have taken on extra capacity to alleviate the busiest ports on the West Coast, dwell times still remain elevated.

As lockdowns in China ease, and exports tick back up, the influx of container ships on the water, headed to the US threaten to drive congestion and wait times back up.

What Can Merchants Do About Freight Delays?

While large enterprises may seem to have the advantage in navigating supply chain disruptions – with the resources to charter their own ships, for example – small to midsize businesses (SMBs) have the advantage of flexibility.

In 2020, SMBs proved themselves to be nimble and adaptable. When retail shopping came to a halt, 77% of merchants pivoted their selling strategy, with 35% opening an online storefront for the first time.

Similarly, in 2021, SMBs navigated an unpredictable Peak holiday shopping season. In the midst of raw material shortages and port congestion, SMBs ordered their holiday inventory earlier, imported into secondary ports, and strategically stored their inventory to lower transit times on final mile delivery.

Looking for a flexible supply chain solution? Reach out to one of our in-house experts today.

Why Is the Cost of Freight So High?

When we surveyed merchants across all industries in 2021, 77% of them reported that the rising cost of freight had affected their business. They responded in various ways:

- 31% increased costs for their end consumers

- 18% rerouted freight or renegotiated their rates

- 12% absorbed the cost

- 9% had to stop offering free shipping

The factors that drove up freight rates are complex and interconnected. They include:

- A truck driver shortage. Demand is high and supply is low. Without enough drivers to operate the vehicles, merchants are competing for limited space on LTL and FTL vehicles.

- A microchip shortage. New vehicles are in short supply due to the microchip shortage that is affecting the car industry as a whole.

- Rising fuel prices. Diesel fuel accounts for around 30% of carriers’ overall operating costs. When fuel prices increase, freight costs will naturally follow.

When Will Freight Rates and Shipping Go Down?

According to a forecast by Coyote Logistics, freight rates have declined in 2022, but carrier capacity is still strained. Their forecast shows truckload rates trending downward by the end of the quarter.

Ultimately, nearly two years of supply chain disruptions has proven that supply chain resilience is the only way to succeed in a volatile market. When the next supply chain disruption comes, the merchants who can quickly pivot and adapt to meet consumer demand will be the most successful.

The qualities of a resilient supply chain:

- An end-to-end solution: Having a single partner to manage your supply chain from the manufacturer to your customer’s doorstep increases visibility and control so you can pivot in the face of disruption.

- Ability to quickly pivot: In a volatile market, it’s important to have the option to ship into secondary ports, move inventory to more strategic warehouse locations, or

- Scalability: In most industries, demand is cyclical, and in today’s digital-first economy, demand can shift suddenly. Successful merchants have the ability to scale operations up or down quickly to respond to changes in demand without depleting their margins.

Ware2Go is committed to helping merchants of all sizes succeed in spite of freight delays with a flexible and scalable supply chain solution. To stay up-to-date on the latest supply chain trends, sign up for our monthly newsletter or follow us on LinkedIn.