Walmart, followed closely by Target, Dick’s Sporting Goods, Best Buy and Kohl’s, announced that their stores would be closed on Thanksgiving this year in response to the COVID-19 pandemic. While none of the retailers have announced detailed plans for Black Friday, most have outlined plans to extend holiday shopping deals and enhance online ordering and curbside pick-up options. All of these changes beg the question, what will the historic holiday shopping day look like this year?

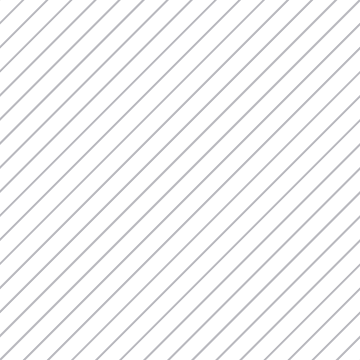

One thing is certain, with 60% of consumers reporting plans to spend less time shopping in stores this year, the ongoing trend towards online shopping isn’t slowing down anytime soon. Brick and mortar retailers will be forced to find creative solutions to this sudden upset in their legacy fulfillment models, while seasoned eCommerce retailers with fully optimized digital channels may find an opportunity to move in on the big box retailers’ long-standing market share of holiday shoppers. Recent survey data shows that since March, 55% of shoppers made purchases from online retailers they had never shopped with before the pandemic, indicating that consumer loyalty may be wavering as major retailers face unprecedented demand in online orders, leading to stockouts and shipping delays. This may prove a distinct advantage for online retailers looking to scoop up sales from consumers frustrated by the unwieldy fulfillment models of traditional retailers.

Competing for Walmart and Target’s Thanksgiving Business

eCommerce retailers and small to medium businesses have a unique set of strengths to leverage during these times of rapid change. Their operations tend to be more nimble and able to pivot quickly to meet changes in demand. Retail giants like Target and Walmart have years of historical data to forecast demand and plan for big sales days like Thanksgiving and Black Friday, but this year those forecasts are moot, plans have been scrapped, and the playing field has been somewhat leveled for businesses of all sizes. SMB’s and eCommerce retailers are more equipped to plan their holiday strategy around the current state of the market and will be able to change course more quickly to meet the demand of what will likely be an unprecedented year for D2C eCommerce orders.

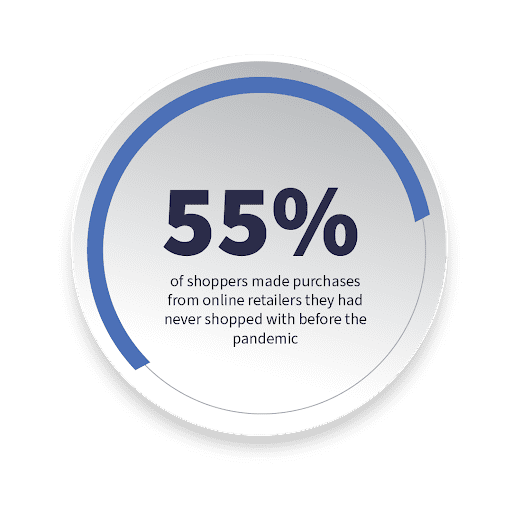

The challenge that many SMB’s looking to compete with big box retailers will face lies in their logistics infrastructures. Speed of delivery has unquestionably become a customer expectation and is only compounded by the often urgent nature of holiday shopping, with over 60% of shoppers expecting to receive their orders in 2 days or less. And shoppers expect this expedited delivery at little to no cost to them, as evidenced by 63% of shoppers citing high shipping costs as their primary reason for abandoning their cart at checkout.

The most efficient method to improve delivery speed without significantly increasing shipping costs is to establish a distributed network of warehouses strategically located to get inventory as close as possible to end customers, allowing for affordable 2-day ground shipping almost anywhere in the country. But many SMB’s may find it difficult to negotiate the warehouse storage, picking and packing rates, or shipping rates necessary to offer affordable 1-2 day shipping. Many warehouses and shipping providers who negotiate rates based on volume may not even look twice at a merchant below a certain threshold of daily order volume. This is why some merchants are outsourcing their logistics to an on-demand warehousing partner that connects them with a distributed warehouse network. By aggregating their order volume with other retailers, these providers are able to negotiate affordable rates for all of their clients and give businesses of all sizes access to pricing and resources previously only available to enterprises, paving the way for new retailers in the eCommerce space.

Inventory planning will be another challenge for SMB’s looking to compete this holiday season. Naturally limited in the amount of inventory they can carry, SMB’s must be particularly vigilant regarding their inventory levels, especially when managing multiple sales channels. Merchants must have accurate daily reporting on inventory levels to avoid costly stockouts and avoidable returns, and the forward-thinking business owner will go one step further to incorporate inventory insights into a multichannel growth plan. The inventory strategy of “ring-fencing” utilizes side by side analyses of inventory levels across all sales channels, allowing merchants to redirect inventory to their higher-performing channels without diverting all of their inventory away from secondary channels. These kinds of real-time aggregated insights are best achieved by funneling all fulfillment through a single, technology-driven logistics provider.

Thanksgiving Closures Usher in the Next Era of Holiday Shopping

The growing trend of online shopping has been thrust into the realm of social norms, and big box retailers will have to pivot to meet this change in demand. While legacy brands like Walmart and Target work to retool their own supply chains, now is the time for more nimble businesses to capitalize on their strengths and carve out their own corner of the holiday shopping market share.

To learn how Ware2Go helped a children’s furniture brand pivot their fulfillment model to support a new way of doing business, watch the story in our On Demand video series. To find out how Ware2Go can help you optimize your fulfillment to compete this holiday season, reach out to one of our logistics experts.